vermont sales tax calculator

This includes the rates on the state county city and special levels. This includes the rates on the state county city and special levels.

Vermont Income Tax Calculator Smartasset

Vermont has a 6 general.

. The state sales tax rate in Vermont is 6. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Other local-level tax rates in the.

Maximum Possible Sales Tax. Find your Vermont combined state and local. The registration application is received from a.

2021 IN-152 Underpayment Adjustment Calculator. Maximum Local Sales Tax. This includes the rates on the state county city and special levels.

Waterbury is located within Washington County. Sales Tax Table For Vermont. The states top income tax rate of 875 is one of the highest in the nation.

The base state sales tax rate in Vermont is 6. Local tax rates in Vermont range from 0 to 1 making the sales tax range in Vermont 6 to 7. Vermont State Sales Tax.

Vermont sales tax details. The average cumulative sales tax rate in Fairfield Vermont is 6. The items that are non-taxable are clothing groceries prescription and non-prescription drugs.

All numbers are rounded in the. Calculator Tue 03012022 - 1200. Average Local State Sales Tax.

Meanwhile total state and local sales taxes. Vermont state does have local sales tax so the total sales tax rate could include a combination of state county city jurisdictions and district tax rates. Depending on local municipalities the total tax rate can be as high as 7.

Theres also a 9 room tax. Before-tax price sale tax rate and final or after-tax price. Fairfield is located within Franklin County VermontWithin.

Tax Year 2021 State of Vermont Annualized Income Installment Method. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. Just enter the five-digit zip code.

The average cumulative sales tax rate in Essex Junction Vermont is 6. If the individual purchases this vehicle at the end of the lease they will pay tax on the residuallease end value of the vehicle. Overview of Vermont Taxes.

Average DMV fees in Vermont on a new-car purchase add up to 70 1 which includes the title registration and plate fees shown above. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Exemptions to the Vermont sales tax will vary by state.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 609 in Vermont. Vermont Documentation Fees.

Well speaking of Vermont the rate of the general sales tax is 6. Sales and Gross Receipts Taxes in Vermont amounts to 12 billion. The Vermont VT state sales tax rate is currently 6.

The average cumulative sales tax rate in Waterbury Vermont is 6. Vermont has a progressive state income tax system with four brackets. Essex Junction is located within Chittenden.

Vermont Cigarette And Tobacco Taxes For 2022

Printable Vermont Sales Tax Exemption Certificates

How To Calculate Sales Tax For Vermont Title Loophole Cartitles Com

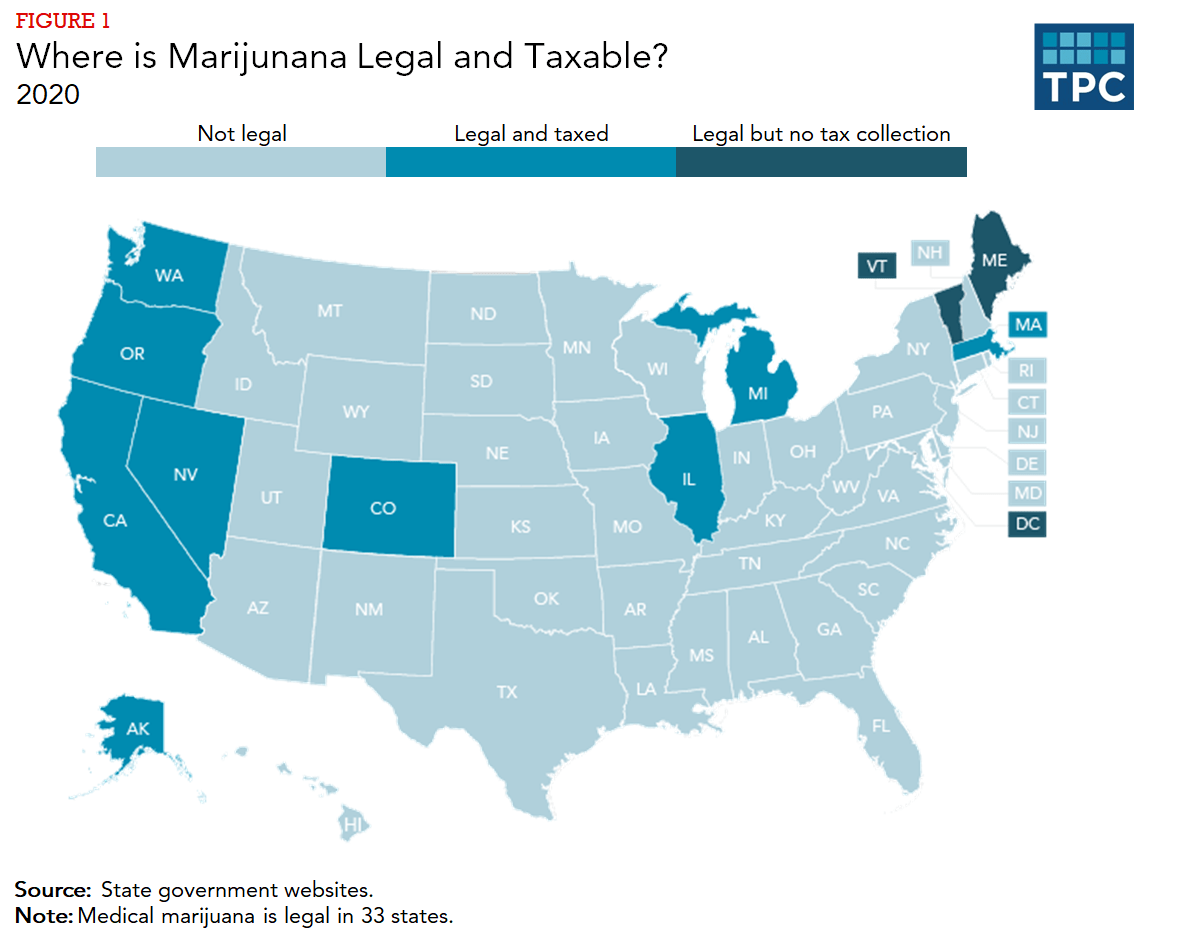

Sales Taxes In The United States Wikipedia

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

State Income Tax Rates Highest Lowest 2021 Changes

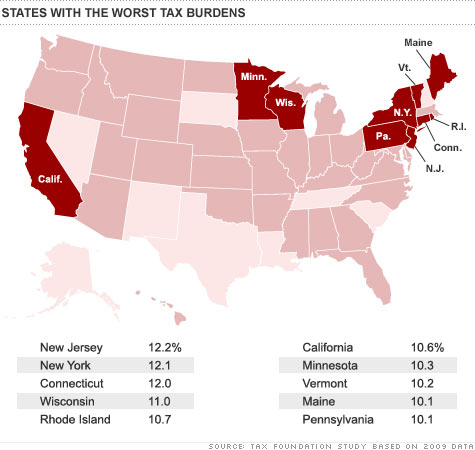

State And Local Tax Burden Falls To 9 8 Of Income In 2009 Feb 23 2011

What S The Car Sales Tax In Each State Find The Best Car Price

States Without Sales Tax Article

Annual Tax Calculator Us Icalculator 2022

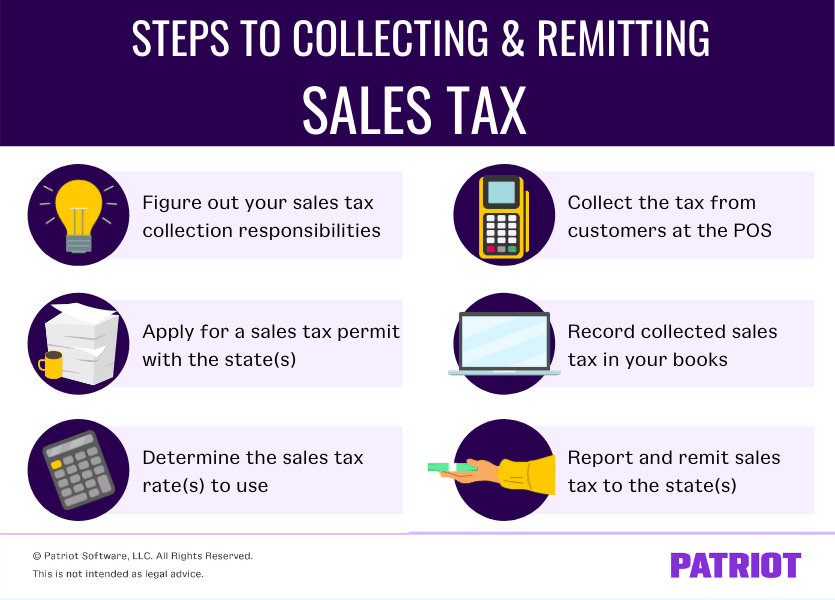

How To Pay Sales Tax For Small Business 6 Step Guide Chart

States With The Highest Lowest Tax Rates

Save Money On Back To School Supplies Even As Costs Are Up

Vermont Real Estate Transfer Taxes An In Depth Guide

State Sales Tax Rates 2022 Avalara

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price